Mitsubishi Corporation (MC) is pleased to announce that MC, Ayala Corporation (AC), and AC Ventures Holding Corp (ACV) have reached an agreement on MC’s investment in ACV subject to the execution of definitive transaction documents and the satisfaction of customary closing conditions. AC is a major conglomerate in the Philippines and ACV currently holds an about 13% stake in Globe Fintech Innovations, Inc. (Mynt), the parent company of GCash, the Philippines’ number one finance super app and largest digital cashless ecosystem in the country. Under the terms of the agreement, MC shall acquire a 50% stake in ACV and pursue future investment opportunities.

In addition, MC and AC are going to sign a memorandum of understanding (MoU) on a comprehensive collaboration in the Philippines. The MoU covers additional business developments aimed at stimulating the country’s economic growth.

MC aims to create a prosperous society and a “Smart-Life” ecosystem in the form of improved lifestyle for consumers by launching multiple attractive businesses that address social issues and consumer needs in each region and country, and organically connecting them. These ecosystem addresses both challenges faced by social issues and consumer needs, and sustainable growth of our business portfolio.

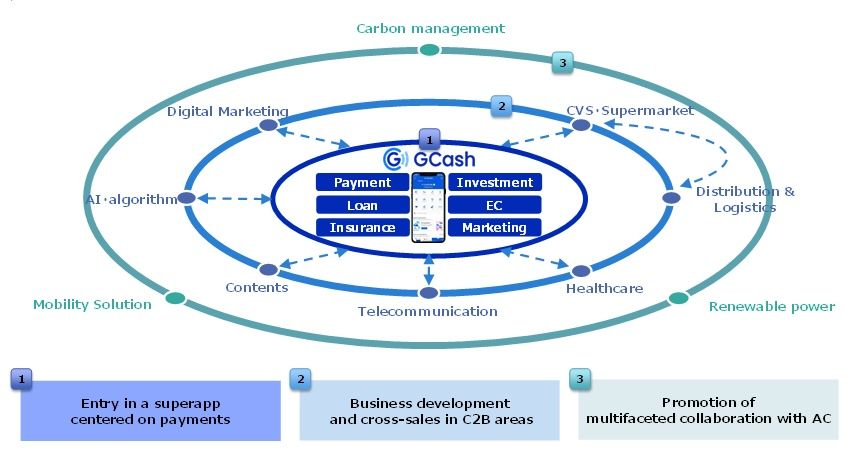

Among the various consumer services, digital financial services are positioned as a critical initiative to capture the growth of consumer demand in ASEAN and to realize a society where everyone can easily access financial services (i.e. financial inclusion). It is also seen as an infrastructure business that organically connects multiple consumer services.

The Philippines is expected to have the highest population and GDP growth among ASEAN countries. Although relatively few people in the Philippines have bank accounts, most have mobile phones and access to the Internet, which makes the Philippines an attractive market with significant room for growth in digital financial services. Approximately 80% of the country’s citizens have ever tried using the “GCash” mobile wallet, which is Mynt’s core business. With a vision to accelerate financial inclusion in the Philippines, the product has by far the largest mobile-wallet customer base in the Philippines and has grown into an indispensable service infrastructure, relied on by millions for daily payments, transfers and other financial transactions. In addition to its digital payments and transfers, Mynt, through its other subsidiaries, also provides access to loan services using non-traditional ways to assign customer credit scores to enable access to fair lending. It has also expanded its financial services offerings to provide users access to savings, insurance, and investment products. Furthermore, it has built the largest network of online and offline merchants including social sellers with over 6 million partners while hosting over 1,000 merchant partners in its app, via GLife.

AC is among the Philippines’ largest business conglomerates. MC first partnered with it in 1974 and has since built up an impressive, nationwide track record of collaborative businesses in various industries. This year marks the 50th anniversary of the partnership, and to further enhance the relationship, the two companies have signed an MoU for comprehensive collaboration. Both MC and AC are committed to boosting Mynt’s corporate value and leveraging other joint initiatives to create new businesses in the Philippines and contribute to its economic development. Those efforts will include continuous business development and cross-sales in C2B area* like retail and healthcare, and multifaceted collaborations in mobility, renewable energy, carbon management and elsewhere.

*In MC, we develop our growth strategies starting from consumer needs under the belief that it is the consumers who hold the power of choice in today’s society with full of goods and services. To emphasize the importance of addressing consumer needs through a ‘market-in’ perspective, we deliberately define and refer to our so-called ‘B2C’ business as ‘C2B’ business.

With the Mitsubishi UFJ Financial Group (MUFG) having also announced its investment in Mynt this past August, MC and AC shall work with MUFG as fellow shareholders to aid the company’s future growth and development.

About Mitsubishi Corporation

Established: April 1, 1950 (Foundation July 1, 1954)

Representative: Katsuya Nakanishi, Representative Director, President and CEO

Number of employees: Non-consolidated 5,421, consolidated 80,037 (as of the end of March 2024)

Business description: The company develops diversified businesses in a wide range of industries through its eight groups: Environmental Energy, Materials Solution, Mineral Resources, Urban Development & Infrastructure, Mobility, Food Industry, S.L.C. (Smart-Life Creation), and Power Solution.

Website: www.mitsubishicorp.com/jp/en/

About Mynt

Headquarters: Taguig City, Philippines

Representative: Martha Sazon, President and CEO

Year of Establishment: 2015

Main Business Activities: Mynt is the first and only $5 billion unicorn in the Philippines. It is a leader in mobile financial services focused on accelerating financial inclusion through mobile money, financial services, and technology. Mynt operates two fintech companies: GXI, the mobile wallet operator of GCash — the #1 finance super app and largest digital cashless ecosystem in the Philippines, and Fuse Lending, a tech-based lending company that gives Filipinos access to microloans and business loans.

About Ayala Corporation

Headquarters: Makati City, Philippines

Representative: Cezar P. Consing, President and CEO

Year of Establishment: 1834

Main Business Activities: For 190 years, Ayala Corporation has been building businesses that enable people to thrive. As one of the largest and most enduring conglomerates in the Philippines, Ayala has established meaningful presence in real estate, banking, telecommunications, and renewable energy. It likewise has a growing presence in healthcare, logistics, mobility, fintech as well as investments in industrial technologies, education, and technology ventures. Ayala manages its corporate social responsibility initiatives through Ayala Foundation.

Materiality

Based on the Three Corporate Principles, which serve as MC’s core philosophy, MC has continued to grow together with society by contributing to the sustainable development of society through its business activities while pursuing value creation. MC’s revised “Materiality” was announced in Midterm Corporate Strategy 2024 as a set of crucial societal issues that MC will prioritize through its business activities, towards the strategy’s goal of continuous creation of MC Shared Value (MCSV). Guided by this Materiality, MC will continue to strengthen its efforts towards sustainable corporate growth. Out of the six material issues relating to “Realizing a Carbon Neutral Society and Striving to Enrich Society Both Materially and Spiritually”, this project’s activities particularly support “Contributing to Decarbonized Societies”,“Promoting Stable, Sustainable Societies and Lifestyles”,”Utilizing Innovation to Address Societal Needs”,”Addressing Regional Issues and Growing Together with Local Communities”.

Inquiry Recipient:

Mitsubishi Corporation

Telephone:+81-3-3210-2171