Published by @prwirepro on

May 15, 2023 – 2022’s record-breaking performances from SCPIs (French Public Real Estate Funds) were coupled with historically high investment volumes and wide typological and geographical diversification.

2022’s SCPIs Investments dynamics

In the follow-up to its 4th annual study of different French Public Real Estate Investment Vehicles, Rock-n-Data presents a new complementary study which focuses on the investments realized by the 107 SCPIs in the market over 2022.

This study shows the perfect allocation of the more than €10 billion raised by SCPIs last year.

SCPIs investment volume up by 52% compared with 2021

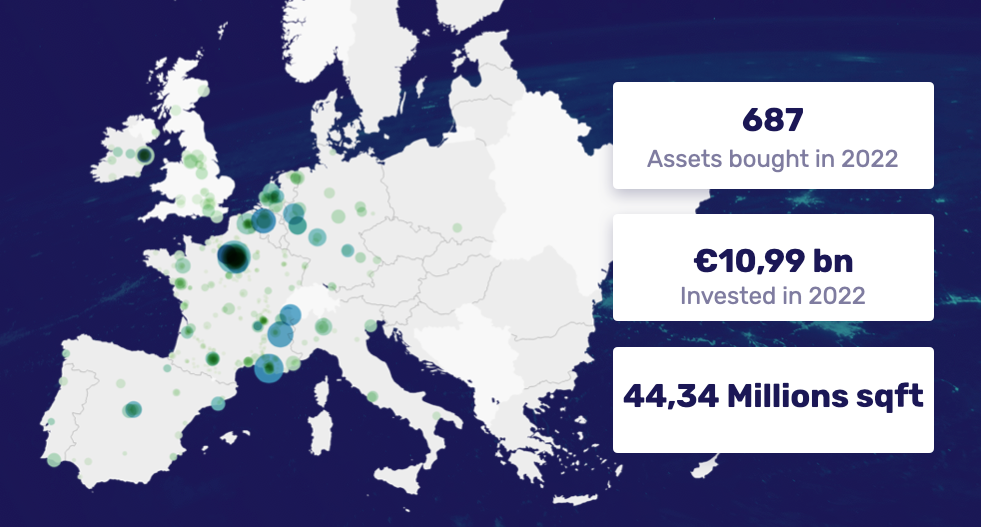

Public savers’ confidence in SCPI was reflected in record amounts raised in 2022. In fact, €11 billion were invested by SCPIs in 2022.

Overall, it represents an equivalent of 687 assets, representing a surface area of approximately 4.1 million square meters (44.13 million sq ft).

In France alone, 511 assets were added to the SCPIs’ portfolio this year, for a total amount of more than €7 billion and for a floor area of more than 2.57 million square meters (27.66 million sq ft).

Geographic distribution of SCPI investments in 2022

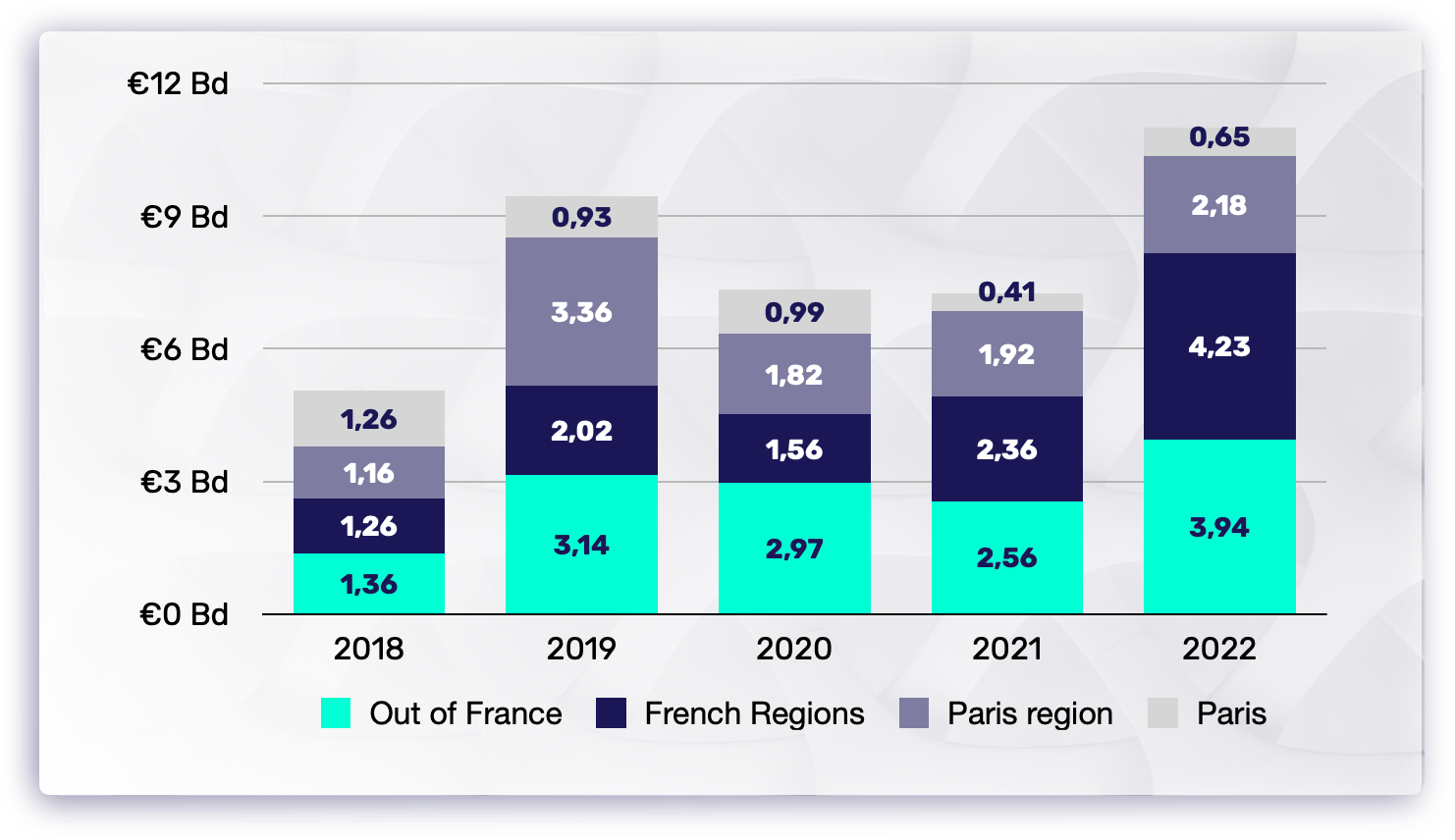

Examining the history, we note that foreign countries and French regions now account for 80% of investments carried out, whereas in previous years Paris and its suburbs accounted for a third of SCPI investment volumes.

In 2022, the foreign countries in which SCPIs invested most were Germany with €856 million, followed by the UK and the Netherlands with €658 million and €609 million respectively.

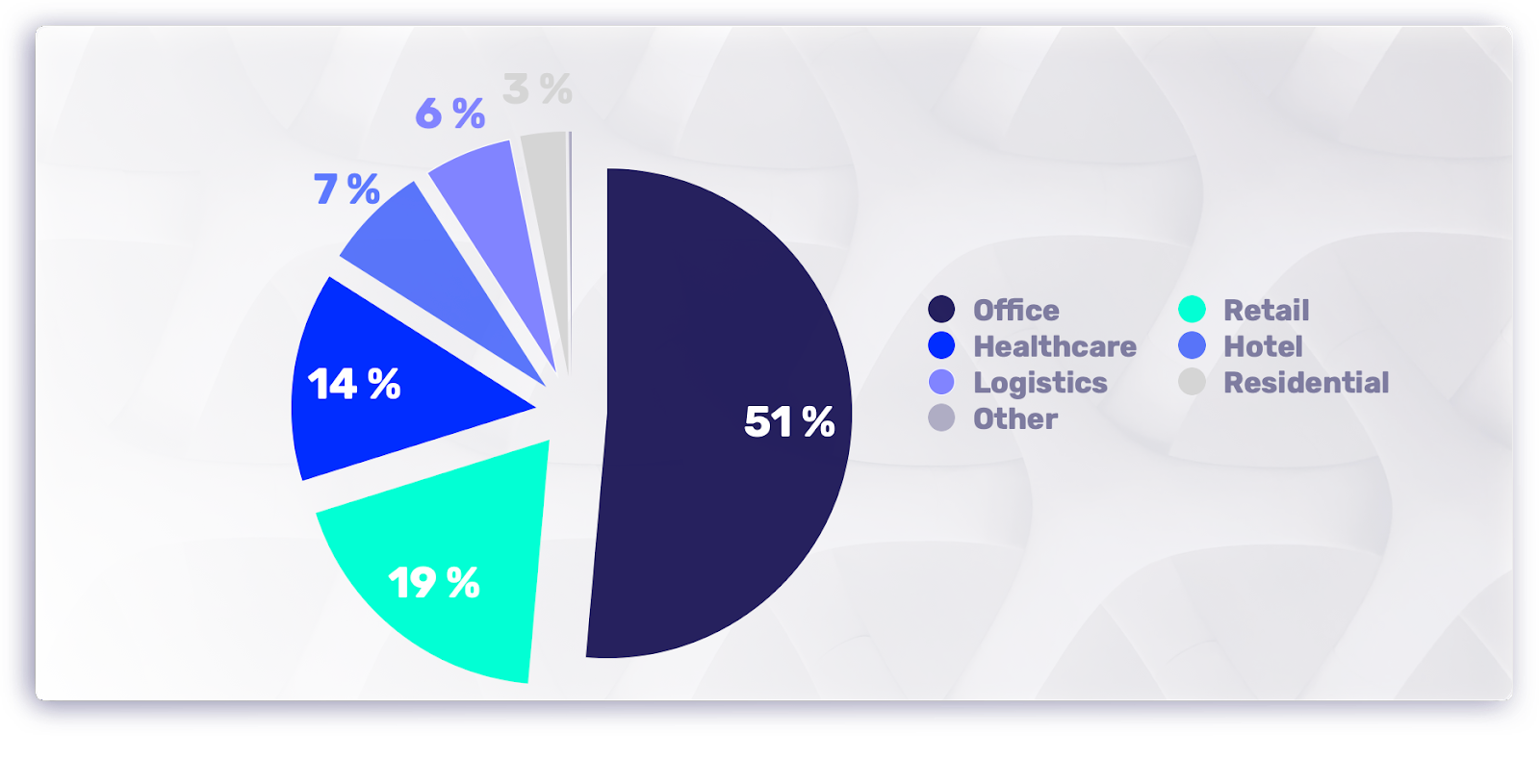

Typological diversification is increasing but historical asset allocation in the office sector remains the dominant one.

Asset allocation of SCPI investments

We note that the share of investments in the alternative types of assets (Healthcare, Logistics, Hotels,…) is rising as compared with office and retail categories. Indeed, new asset classes are becoming increasingly attractive to SCPIs looking for diversification and/or specialization. In quantitative terms, €3.26 billion were invested in these other types of assets, against 1.92 billion in 2021.

Overall, the historical asset classes still dominate. Offices account for 51% of the investments realized by SCPIs in 2022 (i.e €5.41 billion). Office properties are transforming into businesses who offer agile property service adapted to new ways of working (flex offices, brainstorming areas, agoras…).

The two asset types which were most affected by the Covid-19 pandemic are back in the spotlight, particularly Hotels, with a number of major acquisitions realized in 2022. Retail properties have been able to resist strong inflation and related consumption issues, they remain particularly attractive for investors as they offer significant yields.

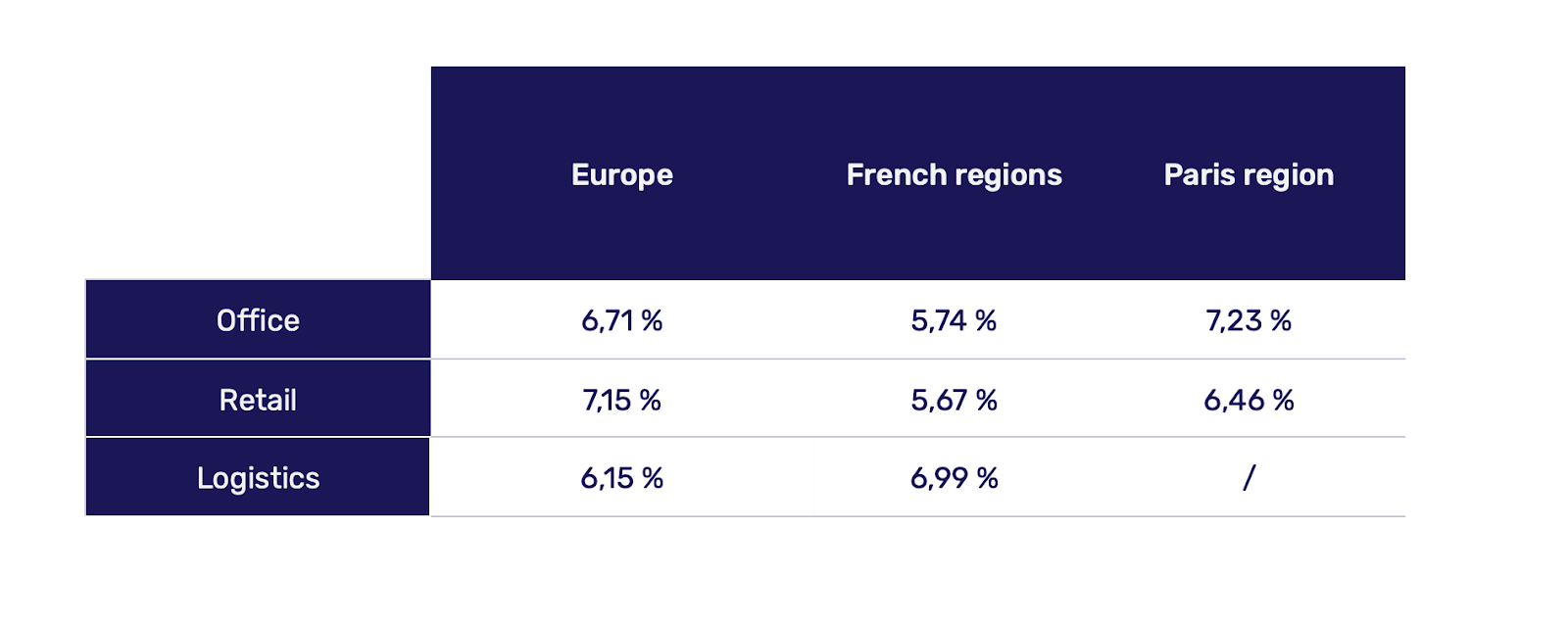

Investment yields on the rise

The macroeconomic context with the French T-Bonds at almost 3% (on 04/17/2023), necessarily drives up the risk premium; which mechanically increases yields.

Investment Yields by Asset Types and Location

It should be noted that the above figures are based on a small sample of acquisitions for which their asset managers report yields, i.e around 30% of realized investments. Furthermore, these are only acquisitions made over 2022 and rates continue to rise still in 2023 in France and other European countries.

In the extension of this reflection, and also because one of Rock-n-Data’s objectives is to allow a better transparency of the Public Real Estate market, we are convinced that a more regular communication on acquisitions’ yields would be beneficial for both investors and savers’ confidence in the products offered to them.

SCPIs are a diversified, long-term yield investment

So far, SCPIs own more than 10,800 assets, representing an area of more than 27 million square meters (290 million sq ft) of space let to around 24,000 tenants. With Hungary as a new country in which SCPIs invested in, these investment vehicles are now present in 17 different European countries and in Canada.

Finally, the “average” SCPI in the market today is perfectly diversified on a location basis with half of its assets in the Paris region and another half allocated between French regions and Europe.

In terms of asset types, the “average” SCPI is still mainly invested in offices (over 60% of assets owned), with a strong diversification within all other classes standing for the remaining 40% .

About Rock-n-Data

Rock-n-Data (a branch of MeilleureSCPI.com) is an innovative PropTech company that brings its expertise in real estate funds to the public sector. We rely on qualified and quantified data, representing more than 200 funds analyzed on a daily basis but also 12,000 assets referenced and available in our database.

Our perfect knowledge of investment criteria also enables us to help fund managers to source real estate opportunities.

To go further, we have decided to launch a matching tool that will aim to match investment criteria to a given opportunity. On the sell side, we offer a new sourcing channel for investors which are able to act quickly and invest cash: identification of selling potential, discretion and speed of operation. On the buy side, we offer a new sourcing channel for properties which perfectly match the requirements of our clients.

Media Contact

Company Name: Rock-n-Data

Contact Person: Rock-n-Data

Country: United States

Website: https://www.rock-n-data.io/fr/

This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.